Greenland – Part II: Northern Lights Eldorado

By Gaia Research Team.

The Gaia Research Team specializes in sustainable mining investments, focusing on responsible resource extraction. Committed to transparency and innovation, the Team aims to transform the mining sector into a more sustainable industry that benefits both the economy and the planet while addressing the huge supply and demand gap for critical minerals.

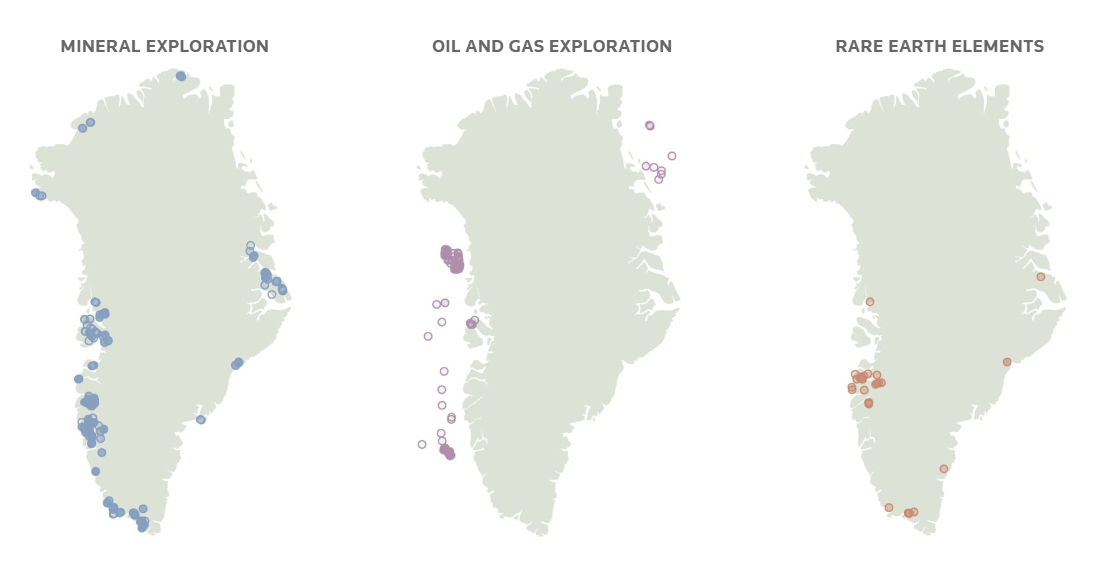

Sectoral Mapping of Greenland’s Mineral Ecosystem

Geologically, Greenland is extraordinarily rich and diverse – so much so that it “would be quicker to list what Greenland doesn’t have” in terms of mineral occurrences (geologyforinvestors.com). From gold and base metals to rare earth elements (REEs) and industrial minerals, deposits are found across the length of the island. However, active mineral sites (those under current exploration, development, or production) are mostly clustered in accessible coastal regions. The inland is dominated by the ice cap and high Arctic mountains, leaving only the ice-free fringe (about 400,000 km²) available for mining (eng.geus.dk).

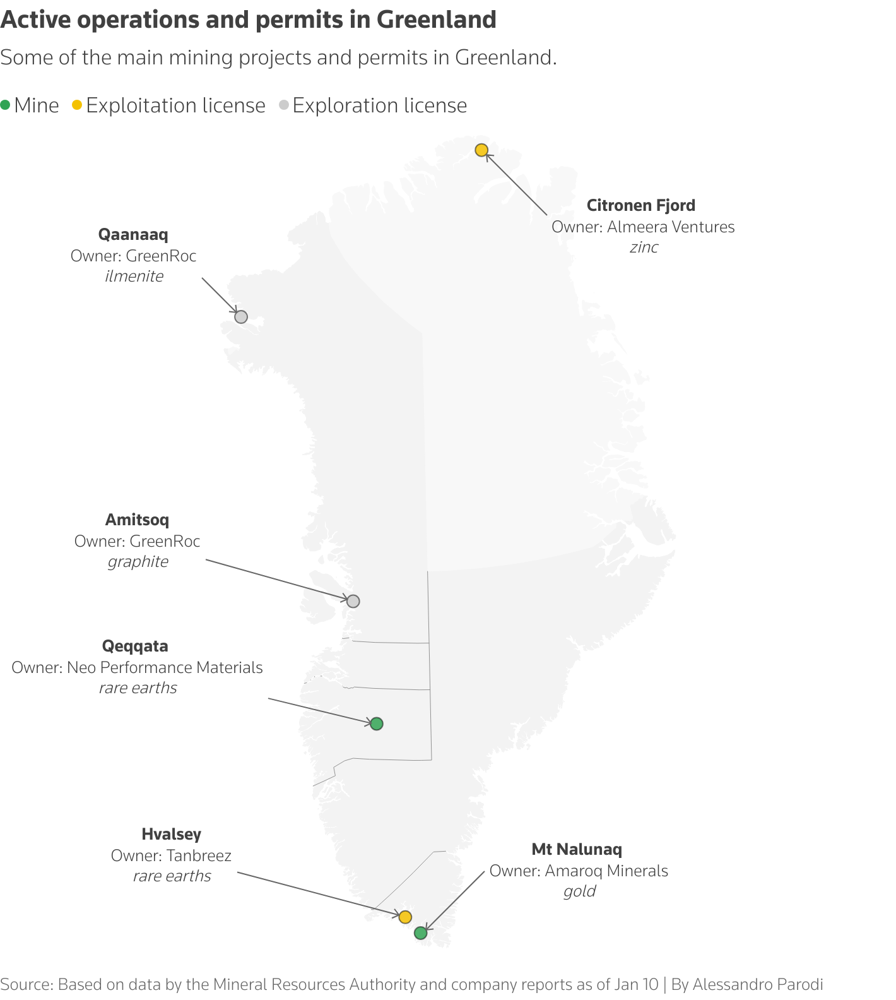

Within this fringe, certain districts stand out: the far south of Greenland hosts world-class rare earth and precious metal deposits, while the far north above the Arctic Circle holds giant base-metal occurrences.

Source: Reuters

Precious and Base Metals Projects

Several high-value metal projects in Greenland have advanced to late-stage exploration or development, promising significant future production. In the south of Greenland, the Nalunaq gold mine is moving toward a restart. Nalunaq was Greenland’s first modern gold producer (operated 2004–2013) and is now owned by Canadian firm Amaroq Minerals. After years of exploration drilling, Nalunaq’s NI 43-101 resource was recently updated in 2025 to about 0.50 million tonnes grading 30 g/t Au roughly 484,000 ounces of gold combined indicated and inferred (globenewswire.com). This ultra-high-grade orebody is undergoing underground development; Amaroq achieved initial test production of gold in late 2024 and is ramping up toward commercial output by end-2025 (business.inquirer.net). If successful, Nalunaq would mark the return of gold mining as a contributor to Greenland’s economy, leveraging its rich grades to overcome the challenges of a remote Arctic operation.

In the far north, the Citronen base metal project stands out as one of the world’s largest undeveloped zinc deposits. Operated by Australian company Ironbark Zinc, Citronen has an updated JORC-compliant resource of ~85 million tonnes at ~4.7% Zn and 0.5% Pb (aspecthuntley.com.au), with an Ore Reserve of 48.8 Mt @ 4.8% Zn, 0.5% Pb “proved + probable” (aspecthuntley.com.au) - equating to over 13 billion pounds of contained zinc-lead metal in situ (nsenergybusiness.com).

A 2017 feasibility study confirmed a viable 14-year mine life at 3.3 Mtpa production (nsenergybusiness.com). The Government of Greenland granted Citronen a 30-year mining license in 2016 (nsenergybusiness.com), and initial site works - including an airstrip and port preparations - began in 2018 (nsenergybusiness.com).

However, full-scale development hinges on financing. To that end, Ironbark has aligned with major industrial backers: China Nonferrous Metal Industry’s NFC signed an MoU to provide engineering, construction and potential 20% project equity in exchange for offtake of the concentrates (nsenergybusiness.com).

This indicates a likely Chinese role in Citronen’s future, supplying capital and technology in return for secure zinc supply. If built, Citronen would be a cornerstone of Greenland’s mining sector – its ~6% Zn ore grade is high by global standards, and annual output could exceed 200,000 tonnes of zinc metal, significantly adding to Western supply of a critical galvanizing and battery metal.

Other metal prospects are at earlier stages. Copper occurrences are documented in several regions (notably north-eastern Greenland), but none have advanced beyond exploration to resource definition (reuters.com). Lead and silver were produced in the past at the Maarmorilik (Black Angel) mine in west Greenland, though that mine closed in 1990. Presently, no major copper or lead projects are nearing development, in part due to limited exploration investment to date (reuters.com). Nonetheless, as global copper demand grows, Greenland’s under-explored copper belts (e.g. along the east coast and in North Greenland) are attracting renewed interest.

One example is the partnership between 80 Mile Plc and KoBold Metals exploring the Disko region (west Greenland) for a Norilsk-style nickel-copper-cobalt sulfide deposit. While focused on nickel, that venture could also appraise copper potential as part of any large magmatic sulphide discovery (reuters.com).

The rest of this article is reserved for signed-in users.

Sign in or create your free account to read the full article.

Comments (0)

Sign in or create a free account to leave a comment.