A New Gold Rush in China

By Laurent MAUREL.

A seasoned investor and financial analyst with over 20 years of expertise in the metals and mining sector. As the founder of Recherche Bay, he provides market analysis and investment insights for Family Offices and Private Equity firms. His expertise includes asset valuation, financial due diligence, and portfolio strategy, with accreditation from the AMF.

Several readers have asked me about the origins of the recent wave of massive U.S. Treasury sales. Some analysts have attributed the recent pressure on the bond market to Chinese divestments, seen as a direct response to the American administration’s protectionist policies.

Personally, I favor a different explanation. In my view, the current stress in the bond market is primarily linked to the unwinding of the basis trade, a phenomenon I detailed in my previous report.

Of course, a large-scale sale by China would undoubtedly add further pressure on long-term U.S. interest rates. However, at this stage, I do not believe we are yet witnessing an escalation of that magnitude in the trade tensions.

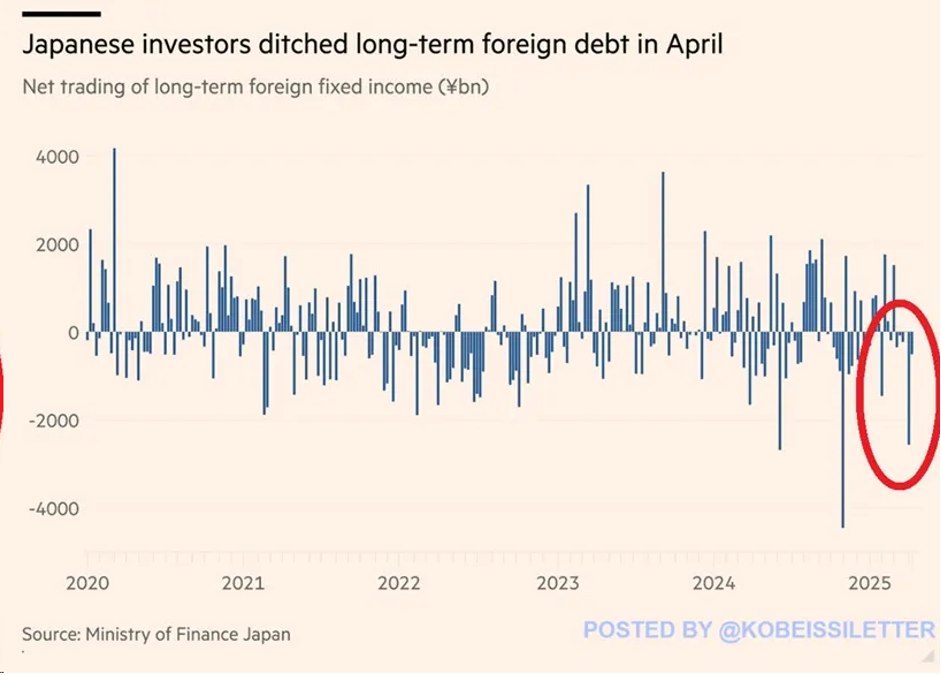

In my opinion, the country most actively contributing to the basis trade deleveraging is Japan. The country is facing a sharp unwinding of the yen carry trade, a process accelerating as Japanese interest rates rise and the yen strengthens against the dollar. This movement is further amplified by the return of inflation in Japan: following the release of an explosive CPI figure (+3.5%), a rate hike now seems inevitable, pushing many investors to liquidate U.S. bonds and stocks to repatriate funds back into yen.

Recent data from Japan’s Ministry of Finance confirms this trend. During the week ending April 4th, Japanese private financial institutions sold $17.5 billion worth of long-term foreign bonds. The following week, they sold an additional $3.6 billion. This represents the largest two-week sell-off since data collection began in 2005.

While the exact breakdown by country was not disclosed, several Japanese market strategists believe a substantial share of these sales involved U.S. Treasuries and mortgage-backed securities (MBS).

In short, far from being the result of a geopolitical maneuver by China, I believe the current stress in the Treasury market mainly stems from a market-driven phenomenon: the forced deleveraging caused by the unwinding of Japanese carry trades, which is now weighing directly on global demand for U.S. debt.

Donald Trump’s recent shift regarding tariffs and the Federal Reserve highlights a reality that is often overlooked: it is no longer politics that sets the rules, but rather the U.S. debt market. Confronted with the “wall of debt,” any attempt at political independence inevitably collides with the silent pressure of financial markets.

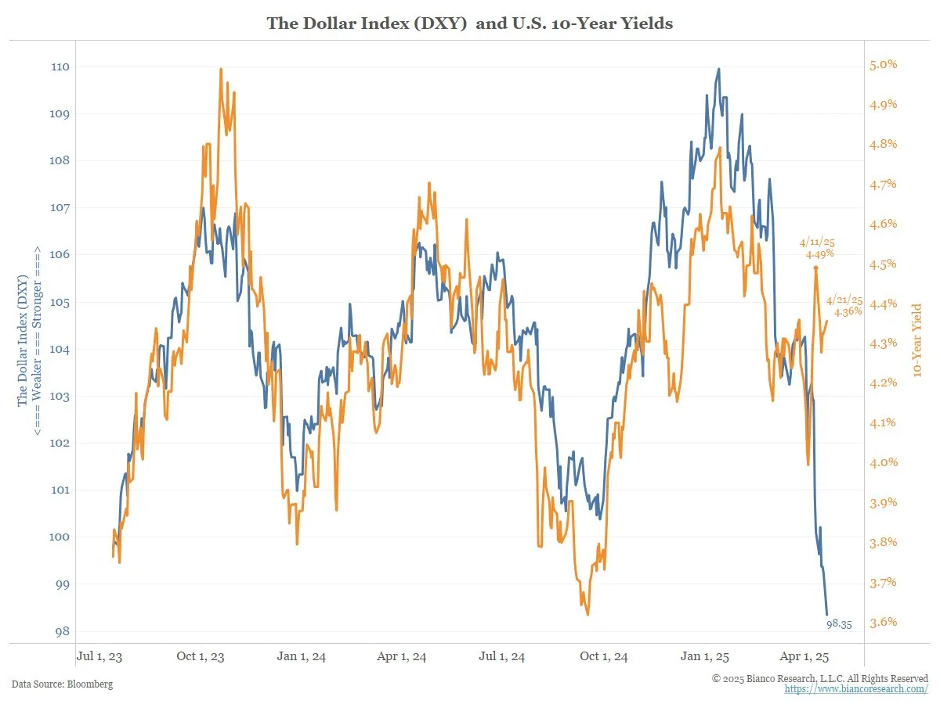

Today, despite an apparent stabilization in equity markets, long-term U.S. interest rates remain elevated. Unlike previous crises, Treasuries are no longer attracting safe-haven capital. This shift signals a structural loss of confidence in the U.S. sovereign signature, fueled by the explosion of public debt, mounting monetary uncertainties, and rising rates in Japan — the latter triggering a broad unwinding of the yen carry trade and accelerating sales of U.S. Treasuries.

At the same time, the financial system is showing clear signs of fragility. Interest rate swap spreads are collapsing, indicating a deep imbalance in the bond markets. Traditional arbitrage mechanisms are breaking down, liquidity is drying up, and investor distrust is rising.

Another worrying symptom: the unusual disconnect between rising U.S. interest rates and a weakening dollar. This rupture in the normal transmission mechanisms of monetary policy points to a growing, latent crisis of confidence.

In this context, physical gold is once again asserting itself as an essential safe haven, while systemic risks — despite reassuring political rhetoric — remain very much present.

The rest of this article is reserved for signed-in users.

Sign in or create your free account to read the full article.

Comments (0)

Sign in or create a free account to leave a comment.